Page 111 - 2016能源統計手冊

P. 111

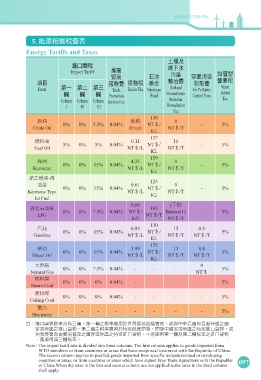

ENERGY PRICES

5. ঐ๕ᗫ൬ڌ

Energy Tariffs and Taxes

ɺᘎʿ

ආɹᗫ ήɨ˥

Import Tariff પᄿ Ϯݑ ̋࠽ۨ

൱ ͩذ ٤ंϮݑ

ධͦ ਕ൬ ي ਿږ ط൬ ԣՓ൬ ᐄุ

Item ୋɓ ୋɚ ୋɧ Trade Excise Tax Petroleum Soil and Air Pollution Value

ᙷ ᙷ ᙷ Promotion Fund Groundwater Control Feex Added

Column Column Column Service Fee Pollution Tax

I II III Remediation

Fee

130

ࡡذ е 0

Crude Oil 0% 0% 2.5% 0.04% (Free) NTă/ NTă/T - 5%

KL

137

ዷࣘذ 0.11 11

Fuel Oil 5% 0% 5% 0.04% NTă/L NTă/ NTă/T - 5%

KL

159

ذ 4.25 0

Kerosene 0% 0% 15% 0.04% NTă/L NTă/ NTă/T - 5%

KL

ঘ٤ዷذ- 123

ذۨ 0.61 0

Kerosene Type 0% 0% 15% 0.04% NTă/L NTă/ NTă/T - 5%

KL

Jet Fuel

0.69 (ɕὮ

૰ʷͩذं 0% 0% 7.5% 0.04% NTă/ 185 Butane)11 - 5%

LPG NTă/T

KG NTă/T

130

ӛذ 6.83 13 0.3

Gasoline 0% 0% 15% 0.04% NTă/L NTă/ NTă/T NTă/T 5%

KL

172

ࣵذ 3.99 13 0.4

Diesel Oil 0% 0% 15% 0.04% NTă/L NTă/ NTă/T NTă/T 5%

KL

˂್ं 0

Natural Gas 0% 0% 7.5% 0.04% - - - NTă 5%

ዷࣘ

Steam Coal 0% 0% 0% 0.04% - - - - 5%

ࡡࣘ

Coking Coal 0% 0% 0% 0.04% - - - - 5%

ཥɢ

Electricity - - - - - - - - 5%

ൗjආɹᗫଟʱމɧᙷfୋɓᙷʘଟቇ͜˰ޢ൱ଡ଼ᔌึࡰdאၾʕശ͏Ϟʝܙ༾ʘ

אήਜʘආɹيfୋɚᙷʘଟቇ͜त֛Эܓක೯eක೯ʕאήਜʘत֛ආɹيdא

ၾҢᖦІ͟൱֛ʘאήਜʘत֛ආɹيfʔቇ͜ୋɓᙷʿୋɚᙷଟʘආɹي

dᏐቇ͜ୋɧᙷଟf

Note : The import tariff rate is divided into three columns. The first column applies to goods imported from

WTO members or from countries or areas that have reciprocal treatment with the Republic of China.

The second column applies to pecified goods imported from specific underdeveloped or developing

countries or areas, or from countries or areas which have signed Free Trade Agreement with the Republic 097

of China.When the rates in the first and second column are not applicable,the rates in the third column

shall apply.